December 19, 2025 Market Overview

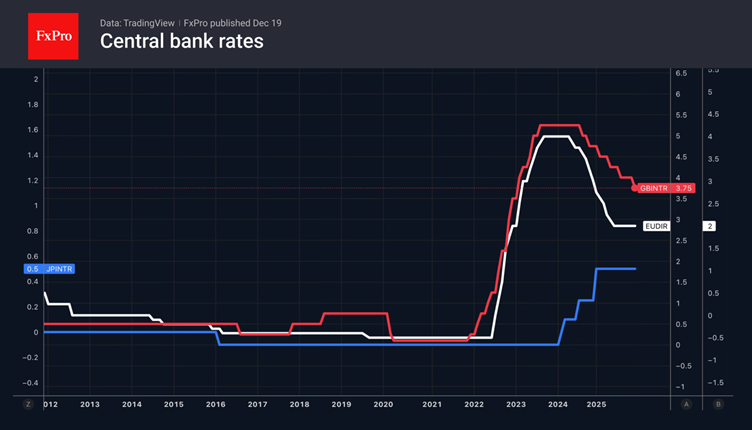

• Central banks prefer to pause. • The strengthening of the dollar prevented gold from reaching a record high. Global central banks are diverging in their policy paths. In the wake of the Fed’s decision, Britain and Mexico have lowered.

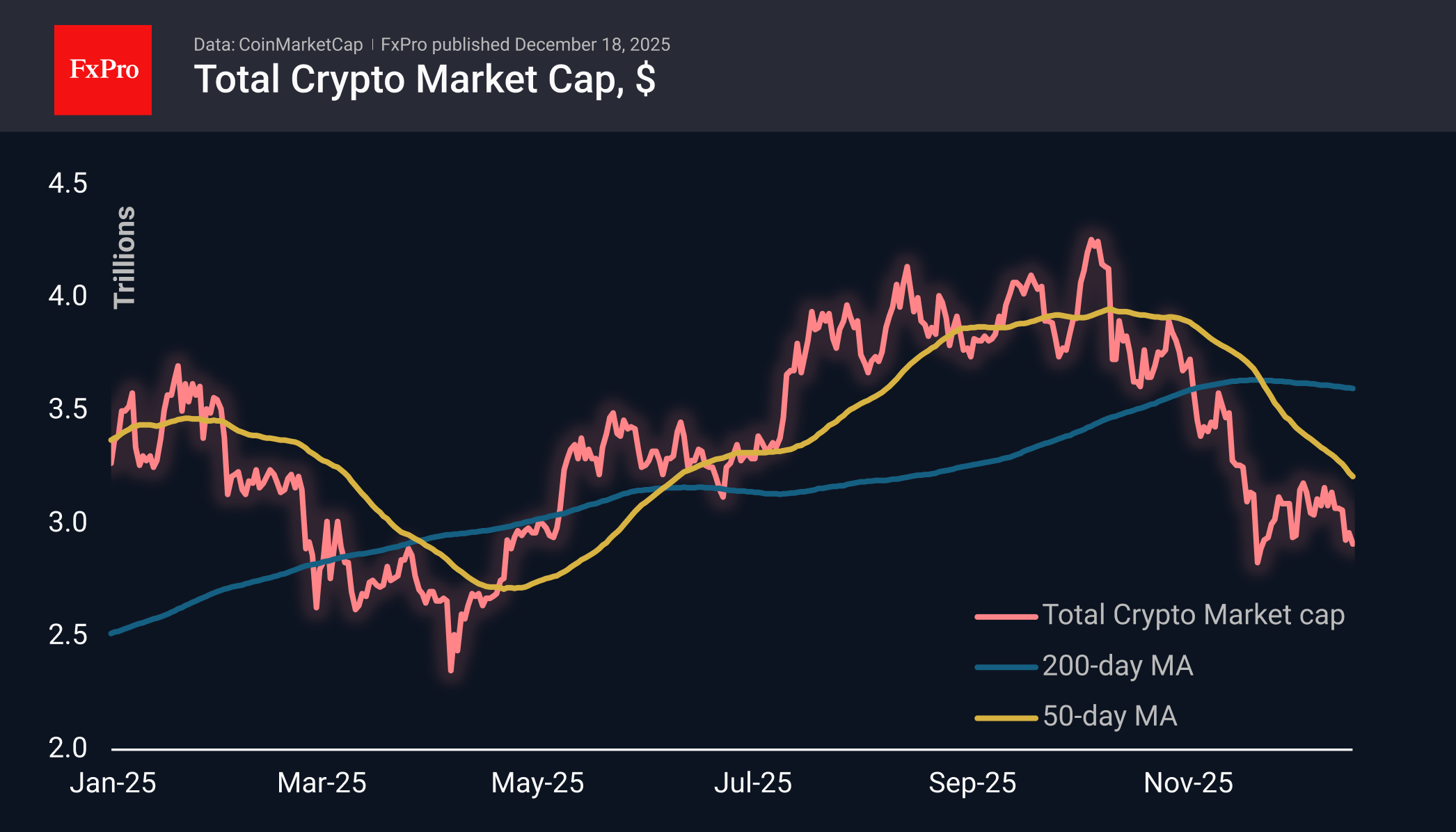

December 19, 2025 Crypto Review

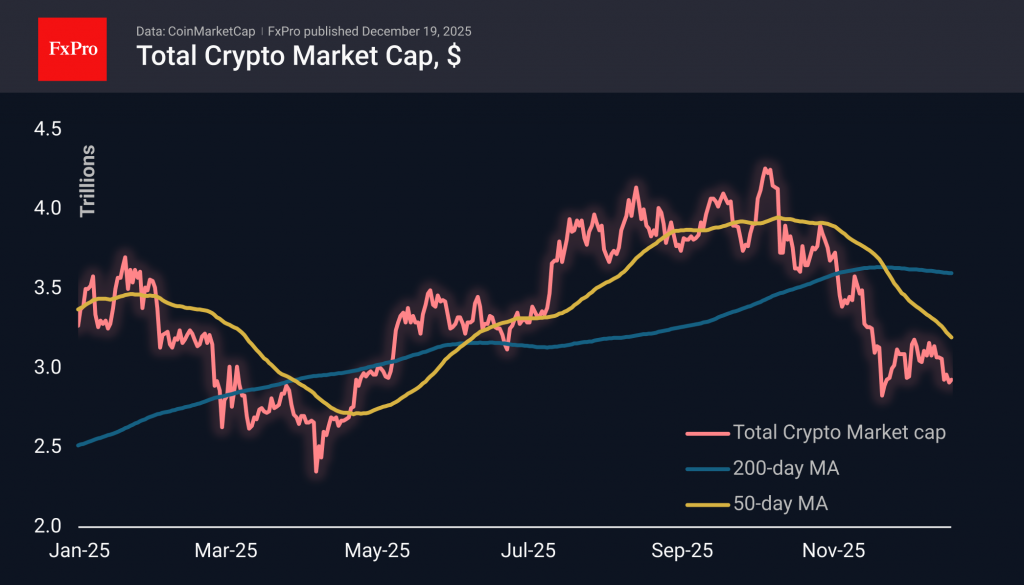

Market Picture The crypto market set another trap for bulls yesterday afternoon, jumping to $3T and then falling to $2.85T. However, on Friday morning, it is once again flirting with buyers, trading at the same level of $2.95T, where it.

December 19, 2025 Technical analysis

JPMorgan Chase: ⬇️ Sell – JPMorgan Chase reversed from resistance area – Likely to fall to support level 1.1600 JPMorgan Chase recently reversed from the resistance area between the key resistance level 320.00 (which has been reversing the price from.

December 19, 2025 Technical analysis

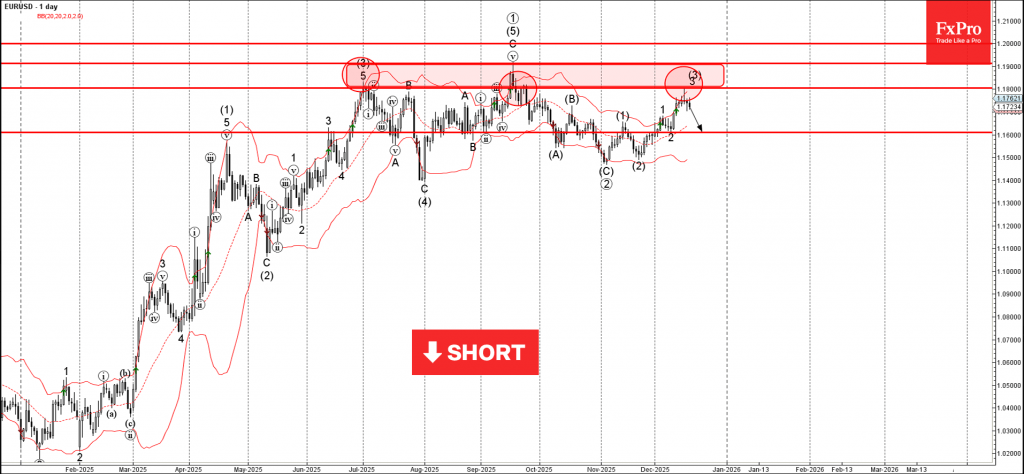

EURUSD: ⬇️ Sell – EURUSD reversed from resistance area – Likely to fall to support level 1.1600 EURUSD currency pair recently reversed from the resistance area between the resistance levels 1.1800 and 1.

December 18, 2025 Technical analysis

AUDJPY: ⬆️ Buy – AUDJPY reversed from support area – Likely to rise to resistance level 104.25 AUDJPY currency pair recently reversed up from the support area between the support level 102.30 (former monthly high from November) and the support.

December 18, 2025 Technical analysis

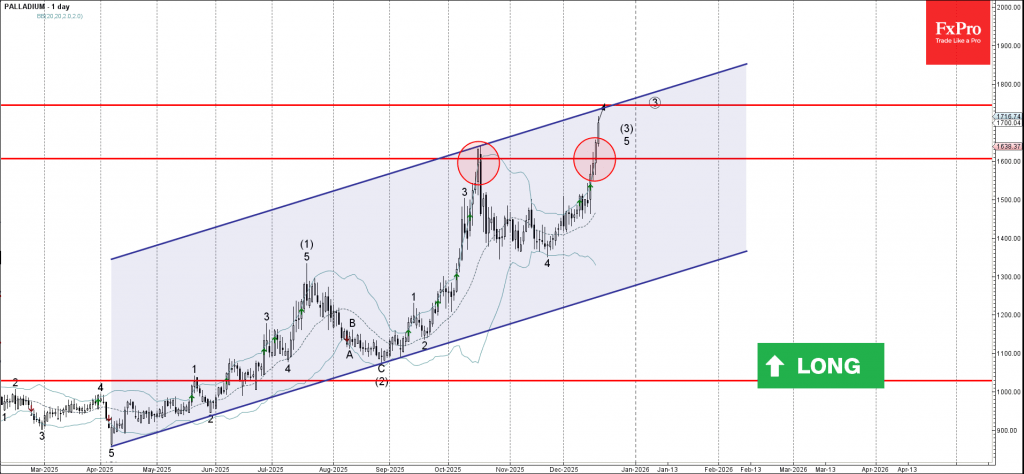

Palladium: ⬆️ Buy – Palladium broke multi-month resistance level 1600.00 – Likely to rise to resistance level 1745.00 Palladium recently broke above the strong multi-month resistance level 1600.00, which reversed the price sharply in October – as can be seen from the.

Today is Thursday, the 18th of December, and we'll be talking about the British pound market where the upward forecast is playing out very well.

#tradelikeapro #trading #tradingstrategy #tradingshorts #gbpusd #gbp

December 18, 2025 Crypto Review

Bitcoin remains stable near $87K, outperforming altcoins, while Solana faces key support at $120. Institutional demand for BTC is rising.

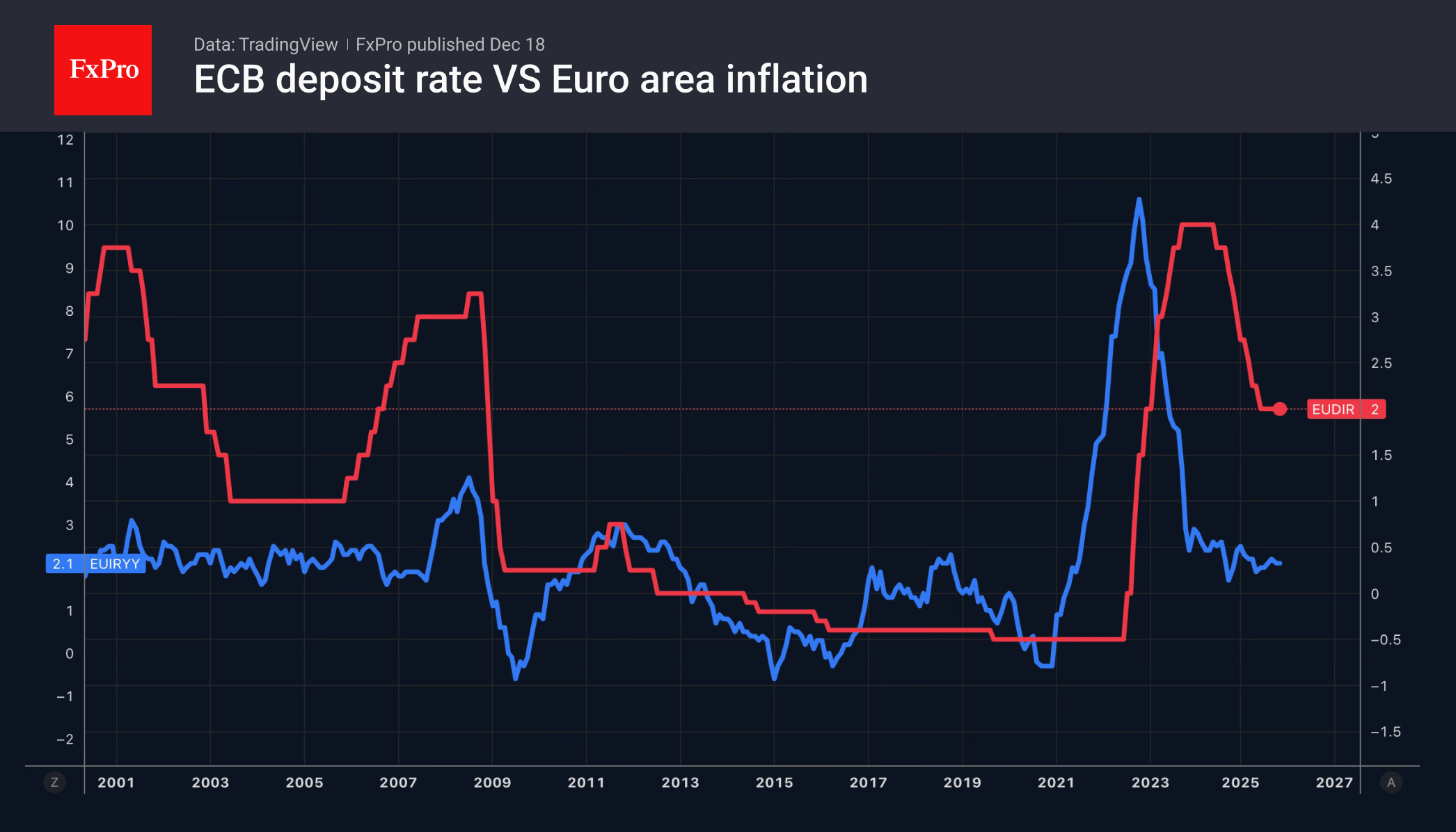

December 18, 2025 Market Overview

Waller's dovish rhetoric halted the bears' attack on EURUSD. Slowing UK inflation caused the pound to fall, while the BoJ is preparing to raise rates.

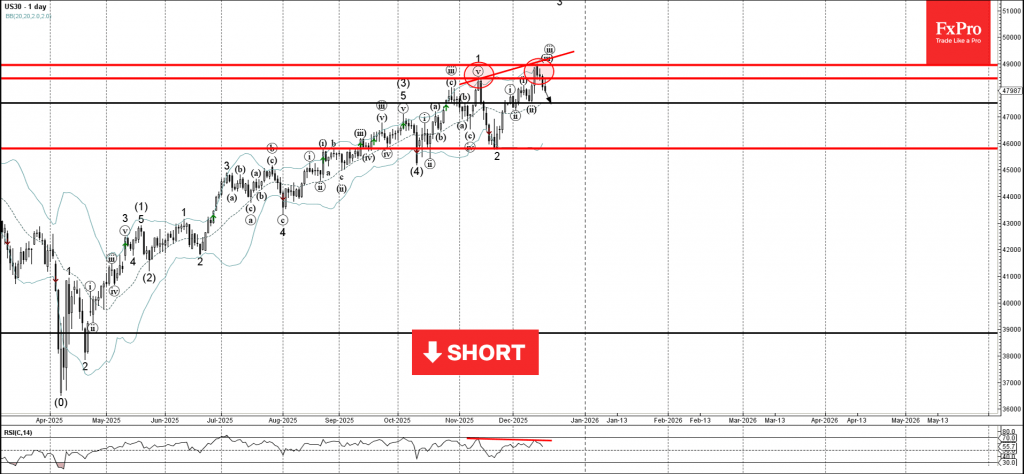

December 18, 2025 Technical analysis

Dow Jones: ⬇️ Sell – Dow Jones reversed from resistance level 49000.00 – Likely to fall to support level 47525.00 Dow Jones index recently reversed from the resistance area between the resistance level 49000.00 and the upper daily Bollinger Band. The downward.

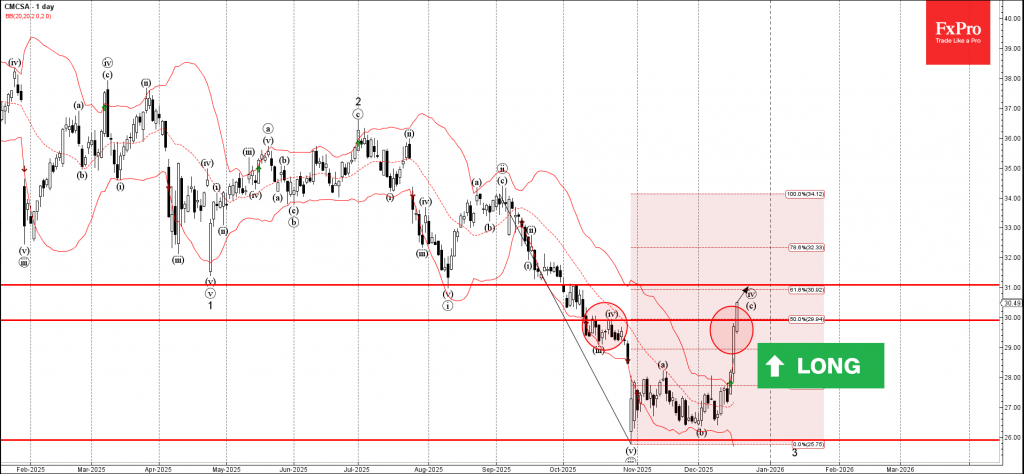

December 18, 2025 Technical analysis

Comcast: ⬆️ Buy – Comcast broke resistance area – Likely to rise to resistance level 31.00 Comcast recently broke the resistance area between the round resistance level 30.00 and 50% Fibonacci correction of the previous sharp downward impulse from September. The.

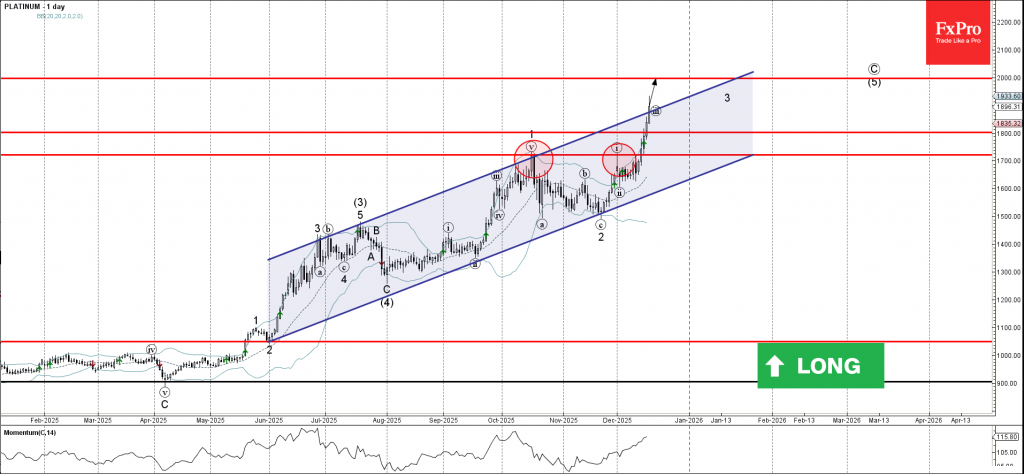

December 17, 2025 Technical analysis

Platinum: ⬆️ Buy – Platinum broke resistance level 1800.00 – Likely to rise to resistance level 2000.00 Platinum rising inside the accelerated the impulse wave 3 which recently broke the resistance area between the resistance level 1800.00 and the resistance.